Structured Settlements

Evaluate the choices available and decide which option is most appropriate.

Overview

Since entering the marketplace, we have provided financial security through structured settlement annuities for the claimants of a variety of lawsuits. Clients look to us for our expertise and ability to create customized, tailored solutions.

Our clients know they can count on us for financial stability and appreciate the security of a trusted company. Our financial strength ratings are among the highest in the industry.1

Quick Links

What is a Structured Settlement?

A structured settlement is an agreement between a claimant and a defendant under which the claimant receives a settlement award in the form of a stream of periodic payments. A structured settlement may be agreed to privately, in a pre-trial settlement, or may be required by a court order, which often happens with judgments involving minors.

In 1982, Congress passed legislation affirming that claimants in personal injury,

wrongful death and worker’s compensation lawsuits could receive their settlement awards as streams of tax-free income payments through a structured settlement annuity. Prior to the legislation, settlements were awarded as single lump sums, and claimants were often burdened with the task of managing the money themselves. Structured settlements provide a solid foundation for future financial security. It is important to carefully evaluate the choices available and decide which payment option is most appropriate.

Benefits of a Structured Settlement

Tax-Free Income

A structured settlement is a one-time opportunity to settle a personal physical injury claim, including wrongful death, with tax-free benefit payments.2 It is tax-free based on Section 104(a)(2) of the Internal Revenue Code. By contrast, the investment earnings on a lump sum payment are usually fully taxable.3

Predictable Income

Guaranteed structured settlement payments can provide claimants with predictable income for the rest of their lives. These payments can be customized to fit their financial needs.4

Guaranteed Payments for Life4

The availability of lifetime payments can be of critical importance to claimants, since lifelong income can provide them with increased financial security. Now that people are living longer, many people are concerned about outliving their savings.

Payments to the Beneficiary

Guaranteed structured settlement payments can be received by the named beneficiary on a tax-free basis.4,5 If a claimant accepts a settlement in a lump sum, there is no guarantee that there will be money available for a named beneficiary after the claimant’s death.

Compare the Benefits

Example

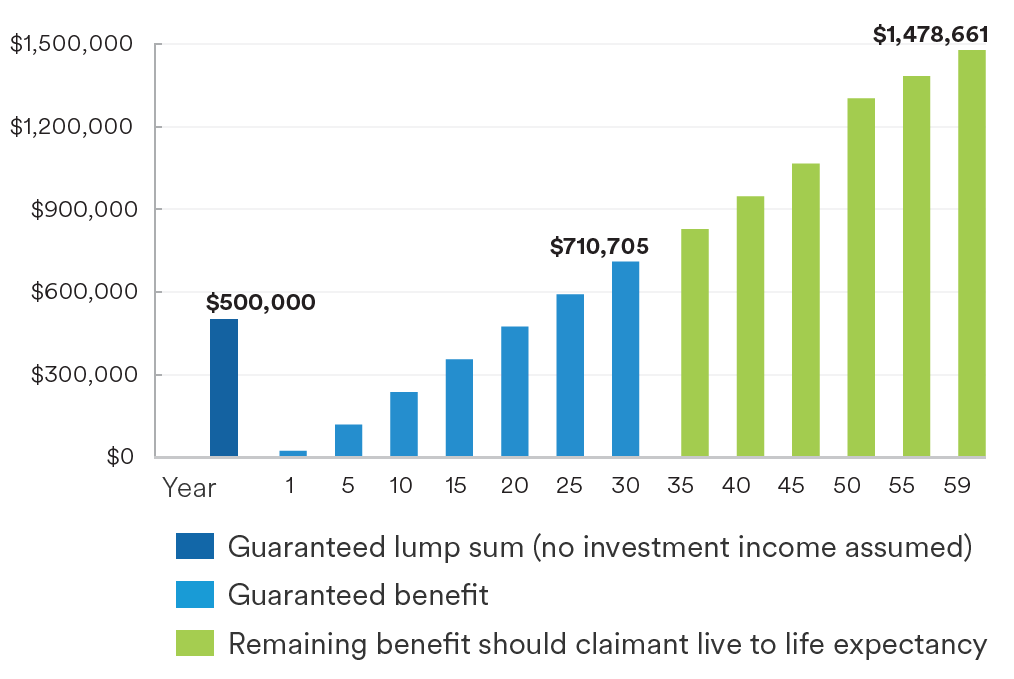

Consider the difference between a lump sum settlement of $500,000 versus purchasing a structured settlement annuity. The settlement, when used to purchase a 30-year certain and life structured settlement annuity with $500,000 for a 21-year-old male, will provide $1,974 per month and a total guaranteed payout of $710,705. If the claimant lives to life expectancy, the total payout would be $1,478,661.

Lump Sum Settlement of $500,000 Versus Purchasing a Structured Settlement Annuity

Download This Slipsheet

Our Advantage

Simple and Easy

- Our superior service makes it easier for you to do business.

- The settlement solution is tailored to meet the claimant’s specific needs for payments.

Expertise

- Work with a dedicated team of industry specialists.

- We have strong experience in navigating changing market condition.

Trustworthy

- We are committed to the structured settlement market.

- Our company’s financial strength is consistently rated highly by major rating agencies.1

Need More Help?

Contact options and Log In for Brokers and Claimants.

1. For current ratings information and a more complete analysis of the financial strength of Metropolitan Tower Life Insurance Company, please go to www.metlife.com and click on “About Us,” “Corporate Profile,” “Ratings.”

2. This tax exclusion does not apply to payments received for punitive damages or to damages received on account of medical expenses previouslydeducted on Federal tax returns. The tax law is subject to change and to different interpretations. We do not provide tax advice.

3. As described by the National Structured Settlements Trade Association.

4. Guarantees are subject to the financial strength and claims-paying ability of Metropolitan Tower Life Insurance Company.

5. Federal and State Estate Taxes may be due upon death based on the value of any remaining payments.

Any discussion of taxes is for general informational purposes only and does not purport to be complete or cover every situation. MetLife, its agents and representatives may not give legal, tax or accounting advice and this document should not be construed as such. You should confer with your qualified legal, tax and accounting advisors as appropriate.

Annuity contracts can be issued by Metropolitan Life Insurance Company (MLIC), 200 Park Ave. NY, NY 10166 or Metropolitan Tower Life Insurance Company (MTL), 5601 South 59th St., Lincoln, NE 68516, two wholly owned subsidies of MetLife, Inc. ("MetLife"). Like most annuity contracts, MetLife annuities contain certain limitations, exclusions and terms for keeping them in force. Ask a MetLife representative for costs and complete details.