MetLifeFinancial

Our financial wellness solutions are designed to meet employees where they are through our multi-channel approach with easy to set up programs and turnkey impactful communications.

Did You Know?

Interest in financial wellness tools and resources as a “must have” benefit has increased to 44% in 2024.1

6 in 10

64% of U.S. employees say they are looking to their employer for more help in achieving financial security through employee benefits.1

3 in 10

35% of employees state they are less productive because of financial stress.

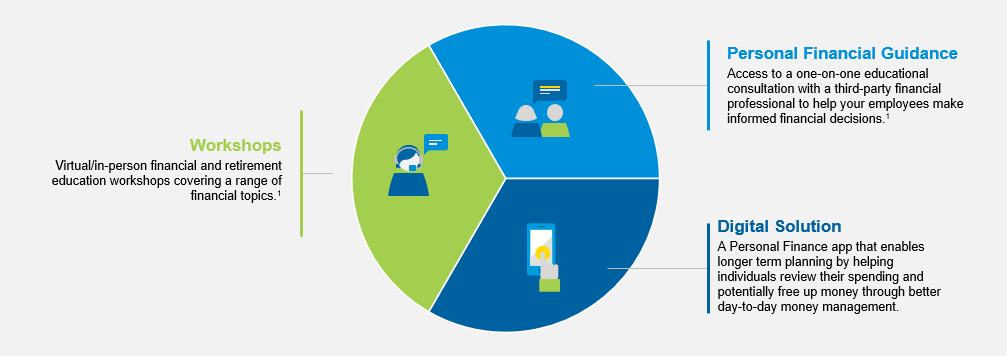

Workshops

Support your employees' financial health with virtual workshops and opportunities for an optional one-on-one personal consultation.

Digital Solution

A personal finance app focused on helping people save more, spend mindfully, and achieve their finance goals.

Transition Solutions

MetLife handles the conversion and portability needs of your group life insurance program, helping individuals make educated decisions regarding their loss of life insurance benefits. For MetLife Insurance customers only.

Educational Resources

Workshops and individual financial guidance for employees affected by changes in their group benefits in the workplace.